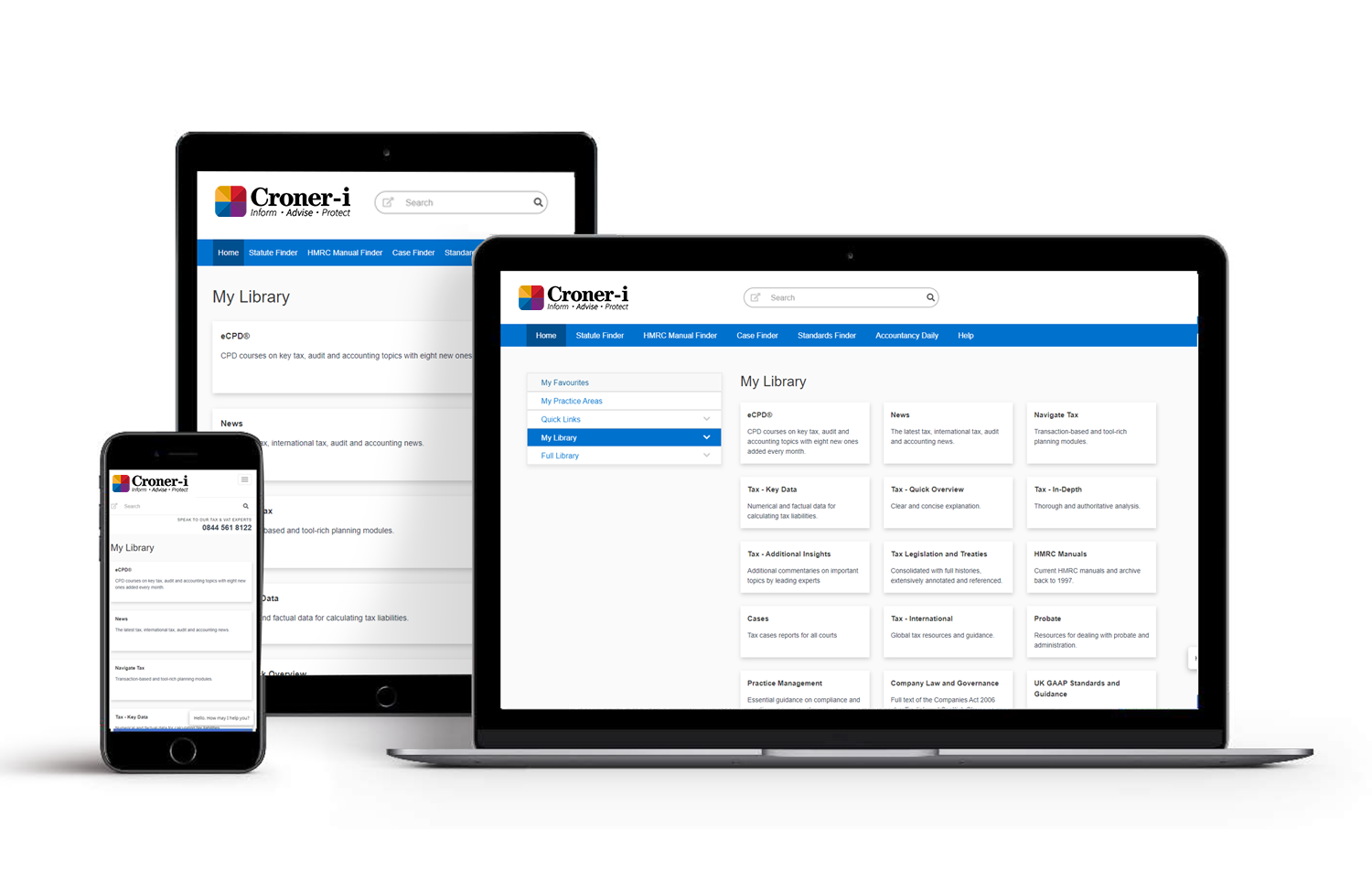

- Tax content arranged by topic from income tax to indirect taxes, at varying levels of detail from key data, to quick overview and in-depth analysis, along with transactional modules from Navigate-Tax.

- Tax legislation, treaties and case databases.

- Essential technical news, analysis and insight for accountancy, tax and audit professionals from Accountancy Daily and other news services.

- Practice management products to help you remain up-to-date and compliant with regulations and assistance on all aspects of running your practice or in-house tax team, be it small, medium or large.

- Legislation and guidance on Company Law, Governance, UK GAAP, IFRS and auditing standards.

Whatever the size of your practice or in-house tax team, our tax experts can provide all the online tax services you need.