The UK’s best financial reporting packages

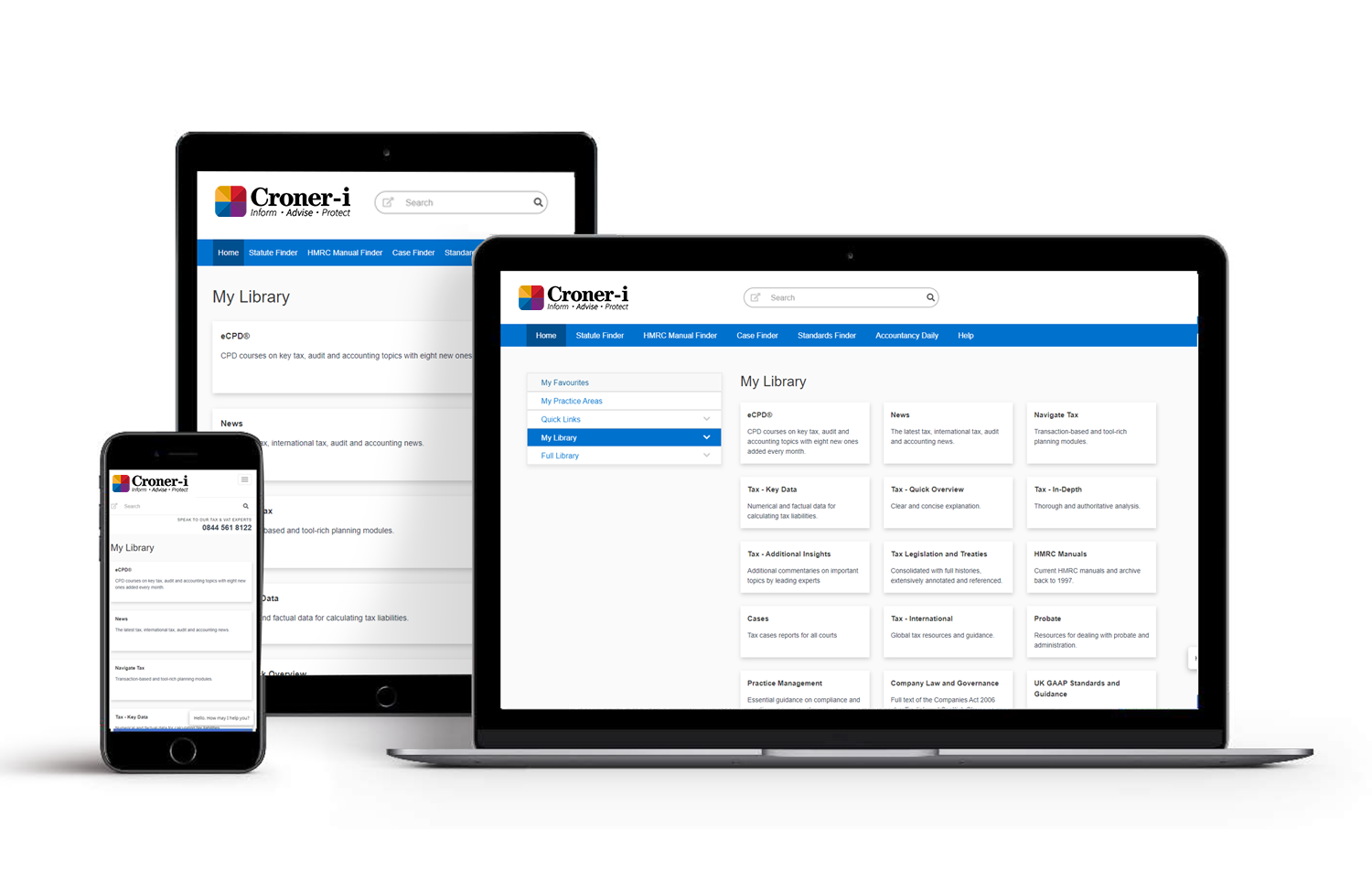

Our online corporate packages have been designed for accountants in business dealing with tax and financial reporting.

Choose from either our...

![]() Corporate Tax & Financial Reporting Essentials Package

Corporate Tax & Financial Reporting Essentials Package

![]() Corporate Financial Reporting Complete Package

Corporate Financial Reporting Complete Package

Both packages are:

- Easy to navigate and tools to save time on disclosure checklists

- feature simple save and share functionality

- help to mitigate against unnecessary costs

- help ensure you stay credible

- include full comprehensive expert opinions on all things financial reporting.